MANDATORY SPENDING VS. DISCRETIONARY SPENDING

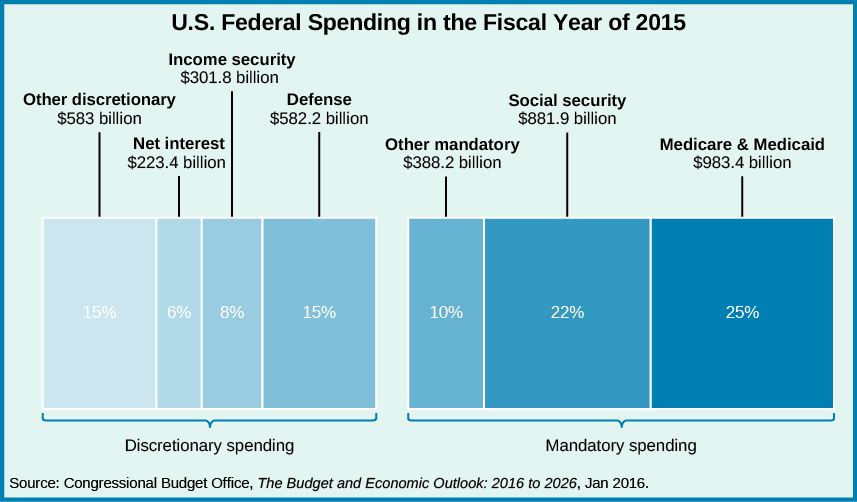

The desire of Keynesians to create a minimal level of aggregate demand, coupled with a Depression-era preference to promote social welfare policy, led the president and Congress to develop a federal budget with spending divided into two broad categories: mandatory and discretionary (see Figure). Of these, mandatory spending is the larger, consisting of about $2.3 trillion of the projected 2015 budget, or roughly 57 percent of all federal expenditures.“Mandatory Spending in 2015: An Infographic,” 6 January 2016. www.cbo.gov/publication/51111 (March 1, 2016).

The overwhelming portion of mandatory spending is earmarked for entitlement programs guaranteed to those who meet certain qualifications, usually based on age, income, or disability. These programs, discussed above, include Medicare and Medicaid, Social Security, and major income security programs such as unemployment insurance and SNAP. The costs of programs tied to age are relatively easy to estimate and grow largely as a function of the aging of the population. Income and disability payments are a bit more difficult to estimate. They tend to go down during periods of economic recovery and rise when the economy begins to slow down, in precisely the way Keynes suggested. A comparatively small piece of the mandatory spending pie, about 10 percent, is devoted to benefits designated for former federal employees, including military retirement and many Veterans Administration programs.

Congress is ultimately responsible for setting the formulas for mandatory payouts, but as we saw in the earlier discussion regarding Social Security, major reforms to entitlement formulas are difficult to enact. As a result, the size and growth of mandatory spending in future budgets are largely a function of previous legislation that set the formulas up in the first place. So long as supporters of particular programs can block changes to the formulas, funding will continue almost on autopilot. Keynesians support this mandatory spending, along with other elements of social welfare policy, because they help maintain a minimal level of consumption that should, in theory, prevent recessions from turning into depressions, which are more severe downturns.

Portions of the budget not devoted to mandatory spending are categorized as discretionary spending because Congress must pass legislation to authorize money to be spent each year. About 50 percent of the approximately $1.2 trillion set aside for discretionary spending each year pays for most of the operations of government, including employee salaries and the maintenance of federal buildings. It also covers science and technology spending, foreign affairs initiatives, education spending, federally provided transportation costs, and many of the redistributive benefits most people in the United States have come to take for granted.“Discretionary Spending in 2015: An Infographic,” 6 January 2016. www.cbo.gov/publication/51112 (March 1, 2016). The other half of discretionary spending—and the second-largest component of the total budget—is devoted to the military. (Only Social Security is larger.) Defense spending is used to maintain the U.S. military presence at home and abroad, procure and develop new weapons, and cover the cost of any wars or other military engagements in which the United States is currently engaged (Figure).

In theory, the amount of revenue raised by the national government should be equal to these expenses, but with the exception of a brief period from 1998 to 2000, that has not been the case. The economic recovery from the 2007–2009 recession, and budget control efforts implemented since then, have managed to cut the annual deficit—the amount by which expenditures are greater than revenues—by more than half. However, the amount of money the U.S. government needed to borrow to pay its bills in 2016 was still in excess of $400 billion“The Federal Budget in 2015: An Infographic,” 6 January 2016. www.cbo.gov/publication/51110 (March 1, 2016).. This was in addition to the country’s almost $19 trillion of total debt—the amount of money the government owes its creditors—at the end of 2015, according to the Department of the Treasury.

Balancing the budget has been a major goal of both the Republican and Democratic parties for the past several decades, although the parties tend to disagree on the best way to accomplish the task. One frequently offered solution, particularly among supply-side advocates, is to simply cut spending. This has proven to be much easier said than done. If Congress were to try to balance the budget only through discretionary spending, it would need to cut about one-third of spending on programs like defense, higher education, agriculture, police enforcement, transportation, and general government operations. Given the number and popularity of many of these programs, it is difficult to imagine this would be possible. To use spending cuts alone as a way to control the deficit, Congress will almost certainly be required to cut or control the costs of mandatory spending programs like Social Security and Medicare—a radically unpopular step.