THE FEDERAL RESERVE BOARD AND INTEREST RATES

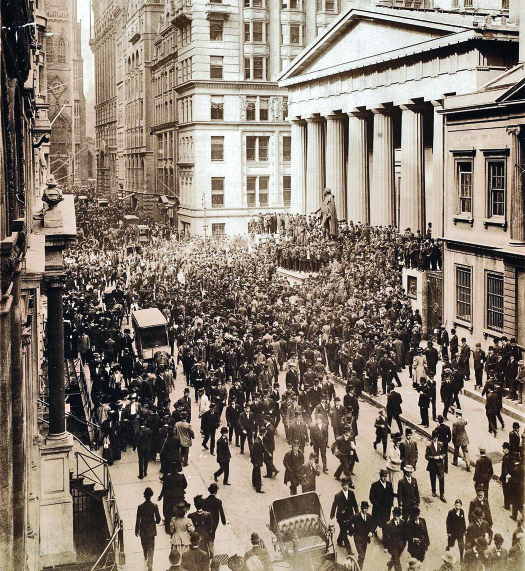

Financial panics arise when too many people, worried about the solvency of their investments, try to withdraw their money at the same time. Such panics plagued U.S. banks until 1913 (Figure), when Congress enacted the Federal Reserve Act. The act established the Federal Reserve System, also known as the Fed, as the central bank of the United States. The Fed’s three original goals to promote were maximum employment, stable prices, and moderate long-term interest rates.“U.S. Code § 225a - Maintenance of long run growth of monetary and credit aggregates,” https://www.law.cornell.edu/uscode/text/12/225a (March 1, 2016). All of these goals bring stability. The Fed’s role is now broader and includes influencing monetary policy (the means by which the nation controls the size and growth of the money supply), supervising and regulating banks, and providing them with financial services like loans.

The Federal Reserve System is overseen by a board of governors, known as the Federal Reserve Board. The president of the United States appoints the seven governors, each of whom serves a fourteen-year term (the terms are staggered). A chair and vice chair lead the board for terms of four years each. The most important work of the board is participating in the Federal Open Market Committee to set monetary policy, like interest rate levels and macroeconomic policy. The board also oversees a network of twelve regional Federal Reserve Banks, each of which serves as a “banker’s bank” for the country’s financial institutions.

The Role of the Federal Reserve Chair

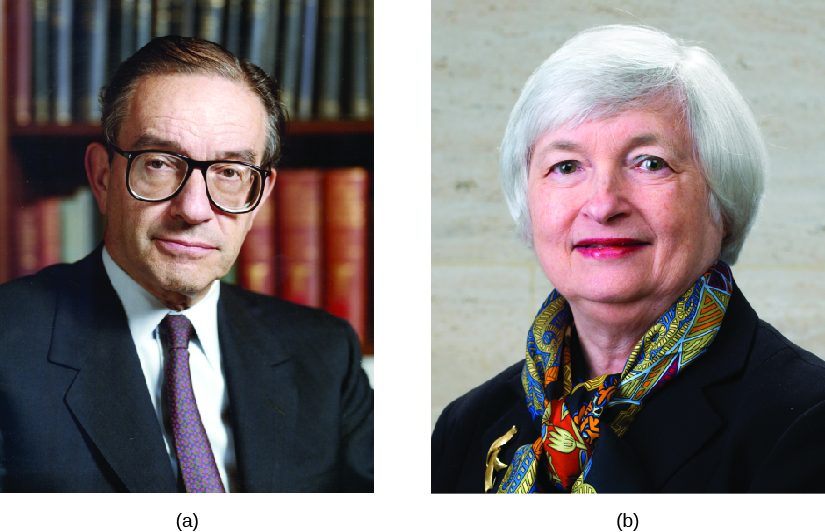

If you have read or watched the news for the past several years, perhaps you have heard the names Janet Yellen, Ben Bernanke, or Alan Greenspan. Bernanke and Greenspan are recent past chairs of the board of governors of the Federal Reserve System; Yellen is the current chair (Figure). The role of the Fed chair is one of the most important in the country. By raising or lowering banks’ interest rates, the chair has the ability reduce inflation or stimulate growth. The Fed’s dual mandate is to keep inflation low (under 2 percent) and unemployment low (below 5 percent), but efforts to meet these goals can often lead to contradictory monetary policies.

The Fed, and by extension its chair, have a tremendous responsibility. Many of the economic events of the past five decades, both good and bad, are the results of Fed policies. In the 1970s, double-digit inflation brought the economy almost to a halt, but when Paul Volcker became chair in 1979, he raised interest rates and jump-started the economy. After the stock market crash of 1987, then-chair Alan Greenspan declared, “The Federal Reserve, consistent with its responsibilities as the nation’s central bank, affirmed today its readiness to…support the economic and financial system.”https://www.federalreserveeducation.org/about-the-fed/history (March 1, 2016). His lowering of interest rates led to an unprecedented decade of economic growth through the 1990s. In the 2000s, consistently low interest rates and readily available credit contributed to the sub-prime mortgage boom and subsequent bust, which led to a global economic recession beginning in 2008.

Should the important tasks of the Fed continue to be pursued by unelected appointees like those profiled in this box, or should elected leaders be given the job? Why?

Do you think you have what it takes to be chair of the Federal Reserve Board? Play this game and see how you fare!